Increasing Construction Activities

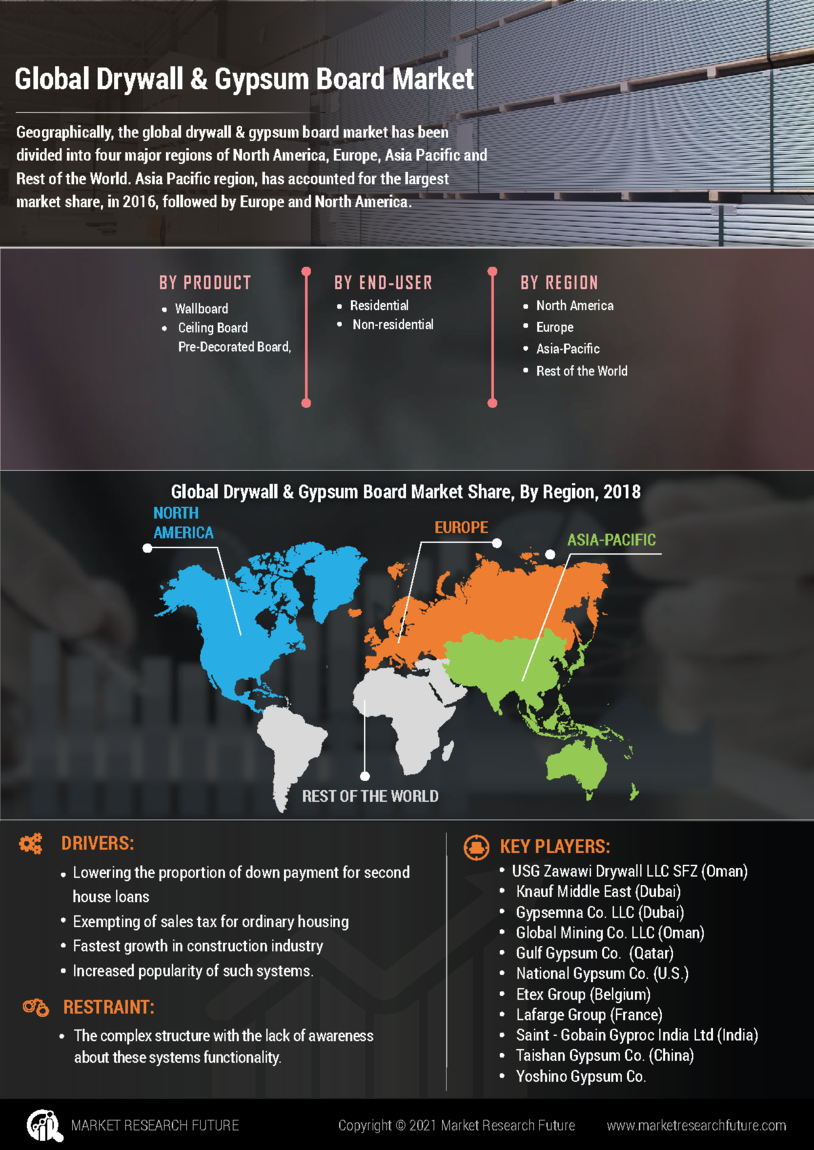

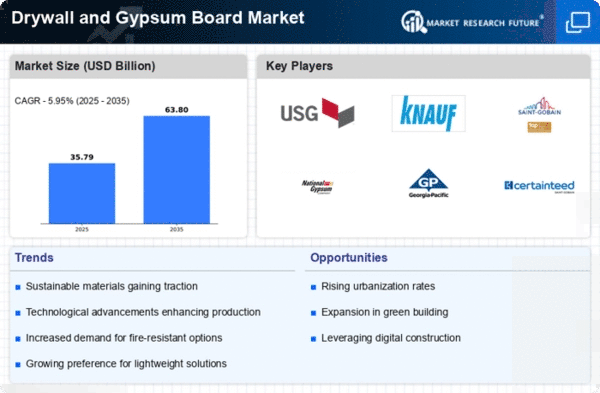

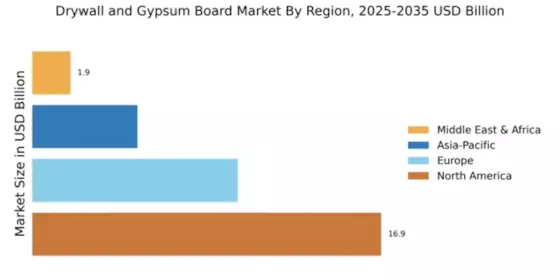

The Global Drywall and Gypsum Board Market Industry experiences robust growth due to the rising number of construction projects worldwide. As urbanization accelerates, particularly in developing regions, the demand for residential and commercial buildings surges. In 2024, the market is valued at approximately 33.8 USD Billion, reflecting the industry's response to increased construction activities. Governments are investing in infrastructure development, which further propels the need for drywall and gypsum board products. This trend is expected to continue, with projections indicating a market value of 63.5 USD Billion by 2035, driven by a compound annual growth rate of 5.9% from 2025 to 2035.

Sustainability and Eco-Friendly Products

Sustainability trends significantly influence the Global Drywall and Gypsum Board Market Industry, as consumers and builders increasingly prioritize eco-friendly materials. Gypsum board products are often manufactured using recycled materials and are recyclable themselves, appealing to environmentally conscious stakeholders. This shift towards sustainable construction practices is likely to enhance the market's growth, as regulations and standards evolve to favor green building materials. The industry's adaptation to these trends not only meets consumer demand but also aligns with global initiatives aimed at reducing carbon footprints. Consequently, the market is poised for expansion as more builders adopt sustainable practices.

Technological Advancements in Manufacturing

Technological innovations play a crucial role in shaping the Global Drywall and Gypsum Board Market Industry. Advances in manufacturing processes enhance product quality and reduce production costs, making drywall and gypsum board more accessible to builders. Automation and improved machinery contribute to increased efficiency, allowing manufacturers to meet rising demand without compromising quality. As the industry embraces these technological advancements, it is likely to witness a surge in productivity and profitability. This trend aligns with the overall growth trajectory of the market, which is projected to reach 63.5 USD Billion by 2035, driven by a CAGR of 5.9% from 2025 to 2035.

Growing Awareness of Fire Safety Regulations

The Global Drywall and Gypsum Board Market Industry is increasingly influenced by heightened awareness of fire safety regulations. As building codes evolve to prioritize safety, the demand for fire-resistant drywall products rises. Gypsum board, known for its fire-resistant properties, becomes a preferred choice among builders and architects. This trend is particularly relevant in commercial and high-rise residential buildings, where safety standards are stringent. The industry's responsiveness to these regulations not only enhances product offerings but also drives market growth. As safety becomes a focal point in construction, the demand for specialized drywall products is expected to increase, further supporting the market's expansion.

Rising Demand for Prefabricated Construction

The Global Drywall and Gypsum Board Market Industry benefits from the increasing popularity of prefabricated construction methods. Prefabrication allows for faster construction timelines and reduced labor costs, making it an attractive option for builders. As more projects adopt this approach, the demand for drywall and gypsum board products rises, as these materials are integral to the prefabrication process. This trend is particularly evident in commercial construction, where speed and efficiency are paramount. The industry's ability to adapt to these changing construction methodologies positions it for sustained growth, contributing to the projected market value of 63.5 USD Billion by 2035.